There is no certainty in life that everything will go well. You cannot predict the next moment of your life. Facing damage emotionally and physically is already devastating. But along with them, if you struggle financially, it can be a completely handful of situations for living.

That is why investing in your safety and security is crucial, as it gives you a moment of relief. Protecting your health, house, and assets is another form of building security for living.

There are multiple types of insurance policies that you can look at and buy for yourself. But here is a list of essentials that you must own.

Life Insurance

Life is precious, and it becomes way more precious when you are responsible for providing. If you are the single breadwinner in your house, you cannot risk your life to affect the financials of your family.

But life can be cruel in most cases. That is why buying life insurance policies gives you a sense of relief that things will be taken care of well when you are not around.

Home Insurance

A house is the biggest investment one makes in their lifetime. But catastrophic situations, or any invasion of criminals, can bring massive damage and loss to your house. Recovering the damages on the property can never be easy for the homeowners.

That is why choosing the right plan for home insurance is crucial to cover the loss and damages.

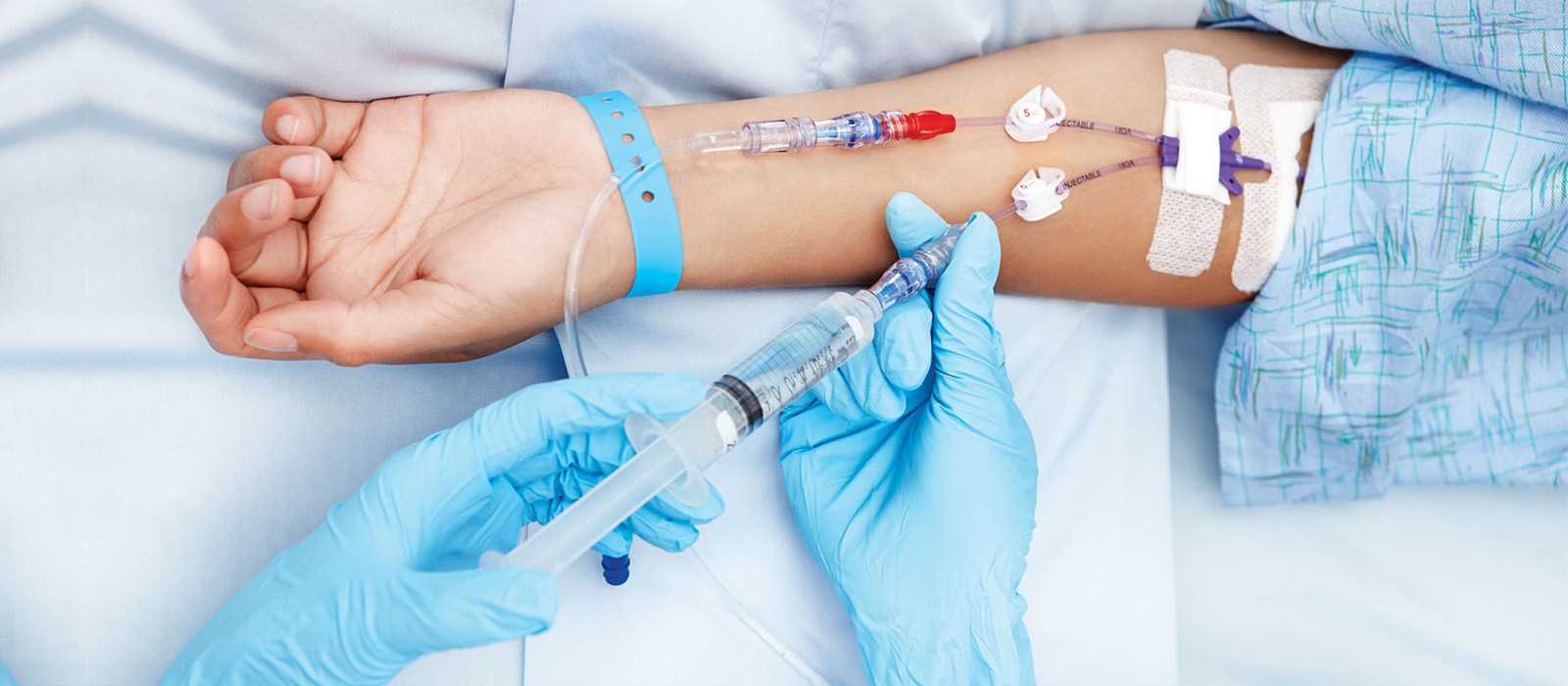

Health Insurance

Health insurance is known as the most important type that will allow you to cover your medical expenses in case of serious illness. As technology is evolving and making healthcare more advanced, the prices of getting treated well by healthcare specialists are skyrocketing.

It can be devastating for a person to face financial challenges in any medical emergency. That is why it is recommended to invest in a health insurance plan that covers a wide range of car and Medicare supplement facilities as well.

This way, you can worry less and focus on the recovery.

Auto Insurance

Auto insurance is one of the crucial types of insurance that you must purchase. If you drive on a regular basis or own an expensive vehicle, you must consider buying coverage for your car to cover the damage or pay compensation in case of an accident.

There are many types of auto insurance plans that you can consider according to your needs. Having auto insurance will allow you to manage your medical expenses after the accident, no matter who was at fault.

Long-Term Disability Insurance

Many people think that their real asset is their car or a house in a great location. But they are wrong. One of the greatest assets a man could have is the ability to earn and make a living. The ability to move freely and live is priceless.

Yet you cannot insure any chance of disability. What if any injury happens to you before you reach retirement and face disability? It can be a life-changing event.

But with long-term disability insurance, you can get the money for treatment and living.