Taxation is integral to any government’s revenue collection system, and the United Kingdom (UK) is no exception. There are various types of taxes that citizens have to pay in the UK, ranging from income tax to taxes on goods and services. For individuals who feel that they may have overpaid their taxes or are eligible for tax rebates, they can choose to use the services of a tax rebate company. A tax rebate company is a professional service that specializes in helping individuals claim back any overpaid taxes. In this article, we will discuss the different types of taxes every citizen must pay in the UK.

Uncommon Facts About the Taxation System in the UK:

The UK has one of the world’s highest levels of indirect taxation. Indirect taxes, such as Value Added Tax (VAT), make up a significant portion of the UK government’s revenue, with over £130 billion collected in 2019-2020.

The UK has a progressive tax system, meaning that individuals with higher incomes pay a higher percentage of their income in taxes. However, the UK also has one of the world’s highest levels of tax avoidance, with an estimated £120 billion lost to tax avoidance and evasion each year.

The UK introduced the world’s first income tax in 1799 as a temporary measure to fund the war against Napoleon. The income tax was eventually made permanent in 1842.

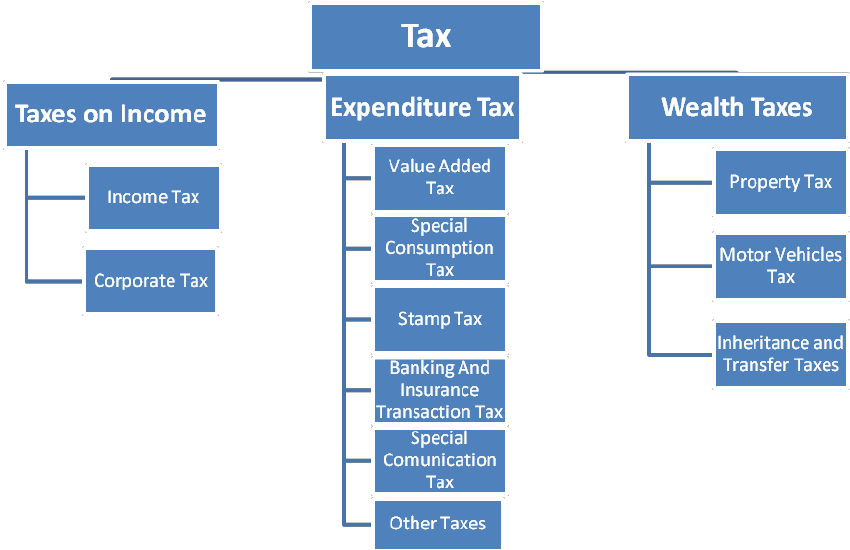

Types of Taxes in the UK

Income Tax

Income tax is one of the most common types of taxes paid by individuals in the UK. It is a tax levied on an individual’s income, which can come from various sources such as wages, salaries, pensions, and rental income. The income tax an individual has to pay depends on their taxable income and the tax band they fall into. The UK has a progressive tax system, meaning the more an individual earns, the higher the tax rate they pay. The standard tax band for the 2021-2022 tax year starts at 20% for taxable income up to £50,270, rising to 40% for taxable income between £50,271 and £150,000 and 45% for taxable income above £150,000.

National Insurance Contributions

National Insurance Contributions (NICs) are another tax paid by individuals in the UK. This tax is levied on an individual’s income, and the amount paid depends on the individual’s salary. The money collected through NICs funds various social security benefits, such as the state pension, jobseeker’s allowance, and sickness benefits. The standard NIC rate for the 2021-2022 tax year is 12% for between £9,568 and £50,270 and 2% for taxable income above £50,270.

Value Added Tax (VAT)

Value Added Tax (VAT) is a tax levied on goods and services in the UK. It is a tax that is added to the price of goods and services, and it is the responsibility of the businesses selling these goods and services to collect and pay the VAT to the government. The standard VAT rate in the UK is 20%, although some goods and services are exempt from VAT, such as food and children’s clothing. VAT is a significant source of revenue for the UK government, with over £130 billion collected in 2019-2020.

Corporation Tax

Corporation tax is a tax levied on the profits of companies and businesses operating in the UK. The tax rate for corporation tax depends on the size of the company’s profits, with the standard rate for the 2021-2022 tax year being 19%. However, companies with profits below £50,000 are eligible for a lower corporation tax rate of 17%. Corporation tax is a significant source of revenue for the UK government, with over £70 billion collected in 2019-2020.

Capital Gains Tax

Capital gains tax is a tax levied on an individual’s profit from selling assets such as property, shares, or artwork. The amount of capital gains tax an individual must pay depends on their taxable income and the profit they make from selling the asset. The standard capital gains tax rate for the 2021-2022 tax year is 20%.

Inheritance Tax

Inheritance tax is levied on the value of an individual’s estate when they pass away. The amount of inheritance tax an individual has to pay depends on the value of their estate, with the standard inheritance tax rate for the 2021-2022 tax year being 40%.