The banking industry is undergoing massive change. This results from increasing technology and innovation, rising competition, embedded finance, consolidation, and evolving customer expectations.

Financial institutions must adapt quickly to the new reality to survive and thrive. They must focus on suitable arenas and business models.

The Future of Banking

Technology is redefining how financial institutions provide and deliver value to their customers. This allows banks to address multiple challenges in parallel, reducing costs and growing profitably.

Banks are becoming platforms, enabling new players to offer digital banking experiences. As a result, traditional banks are under increasing pressure to evolve their business models to compete.

While technology has helped a few fintech create entirely new systems, most products developed in the United States have primarily generated marginal efficiency improvements. Most methods are not designed to fundamentally change how banking, investing, and saving work together today.

Digitalization

Digitalization has changed the way the banking sector works. It has enabled banks to provide customers with new products and services, improve workflow, reduce costs, and collaborate with other sectors.

Digitization has also increased the customer base of the banking industry. It provides round-the-clock access to banking facilities and facilitates cashless transactions.

Moreover, it saves time and reduces human error, which increases customer loyalty.

Financial service providers must rethink all customer interaction points and the processes behind them to stay competitive. They must offer a cutting-edge technology on a scalable and reliable digital IT platform that modernizes and simplifies the entire service experience. Digitalization is essential for improving customer engagement, reducing costs, and optimizing operational efficiency. However, it can also expose financial institutions to regulatory problems.

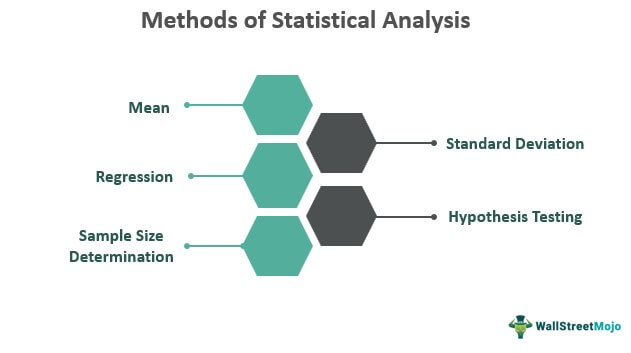

Analytics

Analytics can be used to answer questions about the past, predict the future, and guide decisions. They can help businesses improve performance and increase revenue, increasing profitability.

Business analytics is an iterative process that applies statistical analysis techniques to data to reveal hidden insights that can boost innovation and improve financial performance. It consists of three primary kinds: descriptive, predictive, and prescriptive analytics.

The first step in business analytics is obtaining and analyzing data. The job of the business analytics professional is to make sense of this data and present it in a usable manner. It requires math and computer science knowledge and a strong business and management principles background.

Artificial Intelligence

In the future, artificial intelligence will be a critical part of financial services. Banks can analyze data better, predict customer behavior, and customize financial services.

AI also helps manage repetitive tasks complex for human beings to complete efficiently. This includes functions like processing e-forms, data entry, etc.

Moreover, it reduces errors and saves time in the process. However, AI models may follow biases learned from previous cases of poor human judgment and can result in significant problems.

Banks must offer an appropriate level of explainability to their AI-based systems to avoid calamities. This will help prevent minor inconsistencies from escalating to a significant problems and impacting the bank’s reputation and functioning.

Big Data

Big data is a term that refers to the petabytes of structured and unstructured data that banks and financial institutions may use to predict client behavior and develop strategies. The data accumulated from various sources in ever-increasing amounts, offering enormous analytical opportunities.

Banks can personalize banking and make transactions more efficient by using data. This allows them to create personalized services and offer products targeted to individual needs, helping boost customer loyalty.

Resources:

https://www.mckinsey.com/industries/financial-services/our-insights/embedded-finance-who-will-lead-the-next-payments-revolution

https://www.investopedia.com/terms/f/fintech.asp